Exchange Traded Funds (ETFs) are investment funds traded on stock exchanges, much like stocks. They offer diversified exposure to a collection of assets.

ETFs have surged in popularity among investors due to their simplicity and flexibility. They allow individuals to buy and sell shares in a pool of assets as easily as trading a single stock. This pool can include stocks, bonds, commodities, or a mix of asset classes, mirroring the performance of a specified index.

Unlike mutual funds, which price once at the end of the day, ETFs are priced and can be bought or sold throughout the trading session. This real-time pricing provides investors with the ability to react quickly to market changes. With lower expense ratios and no investment minimums, ETFs are an accessible option for a range of investors seeking portfolio diversification and efficient management of their investments.

Credit: fastercapital.com

The Rise Of Exchange Traded Funds

Exchange Traded Funds, or ETFs, have soared in popularity over the last few decades. What started as a way to track market indices has become an essential tool for investors. Easy access, variety, and cost-effectiveness are key reasons behind their rise.

From Niche To Mainstream

ETFs were once a niche among savvy investors. Today, they are a primary choice for many. This shift is due to their transparent structure and flexibility.

- Launched in 1993, the first ETF had modest beginnings.

- By the early 2000s, investors began embracing the diversity of ETFs.

- Millions now invest in ETFs across sectors, commodities, and beyond.

How Etfs Reshaped Investing

ETFs revolutionized the investment world with their unique features. Individual and institutional investors alike now use ETFs to manage risk and enhance returns.

| Feature | Impact on Investing |

|---|---|

| Lower Costs | Enables more savings for investors. |

| Real-time Trading | Investors can quickly adjust their positions. |

| Diverse Exposure | Access to different markets in one investment. |

The evolution of ETFs continues with new strategies and asset classes emerging. The impact of ETFs on the financial landscape is a story of innovation and growth. ETFs are not just a trend; they are here to stay.

Types And Diversity Of Etfs

Exploring the world of Exchange Traded Funds (ETFs) reveals a spectrum of opportunities. ETFs offer various types to fit different investment goals. Understanding the types and diversity of ETFs is key. Let’s dive into this vibrant world.

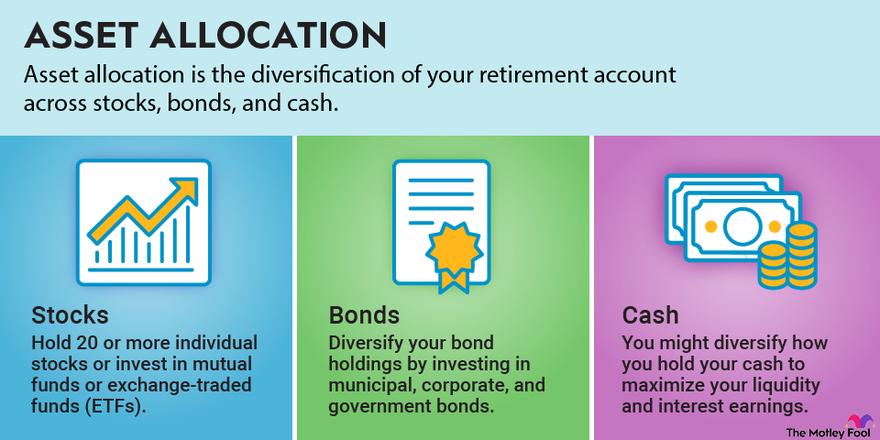

Stocks And Bonds

ETFs often contain stocks or bonds. Stocks represent a share in a company. Bonds are like loans to governments or corporations that pay back with interest. These ETFs come in different shapes:

- Total Market ETFs: Covers many stocks or bonds for diversification.

- Market Cap ETFs: Focuses on companies based on size. Small, medium, or large.

- Income ETFs: Aims to provide regular income from dividends or interest.

Industry-specific Etfs

These ETFs target specific sectors. Investors choose them to bet on industry performance. Popular types include:

- Technology ETFs: Capture the tech sector’s growth.

- Healthcare ETFs: Invest in medical innovations and care.

- Energy ETFs: Focus on oil, gas, and renewable energy.

- Financial ETFs: Tap into banking and investments.

International Exposure

Investors go global with these ETFs. They offer exposure beyond home borders. This can grow your money across the world:

- Developed Markets ETFs: For stable, established economies.

- Emerging Markets ETFs: For faster-growing, riskier countries.

- Global ETFs: A mix of markets worldwide for broad exposure.

Each ETF type suits different strategies. They give choice, reach, and flexibility in investing. Always choose ETFs wisely to meet your goals.

Comparing Etfs With Mutual Funds

Investors often debate whether Exchange Traded Funds (ETFs) or Mutual Funds are the better option. Each one has unique features. These make them suitable for different investment strategies. Let’s look at how they compare across three key dimensions.

Cost Efficiency

ETFs often incur lower yearly fees than mutual funds. This is crucial for long-term growth. Here’s how ETFs save on costs:

- Lower expense ratios: They mean less cost for the investors.

- No sales loads: Unlike some mutual funds, ETFs typically don’t have this fee.

- Less turnover: This can reduce transaction costs internally.

Mutual funds might have higher costs. They pay for active management and marketing.

Trading Flexibility

Trading flexibility differentiates ETFs from mutual funds in significant ways:

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading Times | Throughout the day | End of the trading day |

| Price Updates | Real-time pricing | Once per day |

| Buy/Sell Methods | Limit orders, etc. | Direct through the fund |

ETFs offer more control over the price at which you buy or sell.

Tax Advantages

ETFs often provide better tax efficiency compared to mutual funds. Here’s why:

- In-kind redemptions help minimize capital gains taxes.

- Mutual funds distribute capital gains, causing potential unexpected tax events.

- ETFs with low turnover keep taxable events low.

This can make a big difference in after-tax returns, especially for those in higher tax brackets.

:max_bytes(150000):strip_icc()/Modern-Portfolio-V2-9a0e2a7c92764f0cb194615eaedcdd76.jpg)

Credit: www.investopedia.com

Strategies For Etf Investment

Smart investing requires a strategy that aligns with your goals. With Exchange Traded Funds (ETFs), you have the flexibility to adopt various investment approaches. These strategies help maximize gains while managing risks. Let’s explore some effective investment strategies that can optimize your ETF portfolio.

Core-satellite Approach

The Core-Satellite strategy is a popular method for building a balanced ETF portfolio. It involves a ‘core’ of long-term, stable investments complemented by ‘satellite’ holdings aimed at higher returns.

- Core investments could include broad-market ETFs, carrying low fees and providing steady growth.

- Satellite positions target specific sectors, themes, or strategies potentially yielding higher profits.

This approach provides a strong foundation with the opportunity to capitalize on market trends.

Dollar-cost Averaging

Dollar-Cost Averaging (DCA) is a strategic practice where regular, fixed-amount investments are made in ETFs. This strategy works well in reducing the impact of market volatility.

- Invest consistently, regardless of the ETF price.

- Decrease the average cost per share over time.

- Stay disciplined and potentially decrease investment risk.

With DCA, you can build your ETF investments gradually and steadily.

Tactical Asset Allocation

Tactical Asset Allocation (TAA) is a dynamic ETF investment strategy. It involves adjusting your portfolio to exploit short-term market opportunities.

| Step | Action |

|---|---|

| 1 | Monitor market trends closely. |

| 2 | Change asset allocation to favor strong-performing ETFs. |

| 3 | Rebalance periodically to original investment objectives. |

TAA allows seasonal adjustments in response to economic shifts, political events, or market movements.

Risks And Considerations

Investing in Exchange Traded Funds (ETFs) can be smart. But risks exist too. It’s crucial to know these before investing.

Market Volatility

Prices of ETFs bounce up and down fast. This happens because of the stock market’s nature. The value of an ETF can shift rapidly due to economic changes or global events. A well-diversified portfolio can help, but cannot remove all risk.

Liquidity Concerns

Some ETFs may be hard to buy or sell at a good price. Liquidity refers to how easy it is to trade an ETF. Popular ETFs are usually liquid; others are not. Low liquidity can lead to higher trading costs or difficulty exiting a position.

Tracking Errors And Costs

- Tracking error happens when an ETF does not match its index.

- This can be due to many factors like the ETF’s structure or management style.

- Costs matter too. They can reduce returns. Think about management fees or operational expenses.

Credit: www.fool.com

Incorporating Etfs In Your Portfolio

Exchange Traded Funds (ETFs) stand out as a versatile tool for investors looking to enhance their portfolios. With a blend of stocks, bonds, or commodities, ETFs offer a straightforward way to access various market segments. Understanding how to craft a portfolio with ETFs is key to success in meeting financial objectives.

Aligning With Investment Goals

- Identify Objectives: Start with clear financial targets, such as retirement or education.

- ETF Selection: Choose ETFs that match these targets, whether they focus on income, growth, or stability.

- Risk Tolerance: Align ETF choices with how much risk is acceptable.

Diversification Strategies

Diversification is a core strength of ETFs. They help spread risk across various assets, reducing the impact of market volatility. Creating a balanced portfolio with ETFs that cover different industries, geographies, and asset classes is essential.

| Asset Class | ETF Example |

|---|---|

| Stocks | Index-based ETF |

| Bonds | Government Bond ETF |

| International | Global Market ETF |

Rebalancing And Monitoring

Rebalancing is crucial to maintaining a portfolio aligned with investment goals. Markets change, and so should the ETF composition within a portfolio.

- Analyze Performance: Regularly check how the ETFs perform against benchmarks.

- Adjustments: Make necessary shifts in the ETF portfolio to stay on target with investment goals.

- Stay Informed: Keep up with market trends to ensure ETFs in the portfolio are still suitable choices.

Frequently Asked Questions Of Exchange Traded Funds

What Are Exchange Traded Funds?

Exchange Traded Funds (ETFs) are investment funds traded on stock exchanges, similar to stocks, that hold assets like stocks, commodities, or bonds.

How Do Etfs Differ From Stocks?

ETFs represent a collection of assets, while stocks signify ownership in a single company, offering diverse exposure versus concentrated risk.

Can You Buy One Share Of An Etf?

Yes, like individual stocks, you can purchase a single share of an ETF on the stock exchange through a broker.

Do All Etfs Track Indexes?

Most ETFs track an index, such as the S&P 500, but there are also actively managed ETFs that don’t track indexes.

Are Etfs Suitable For Beginners?

ETFs are often recommended for beginners due to their diversification, low costs, and ease of trading.

What Are The Tax Benefits Of Etfs?

ETFs are tax-efficient because their unique structure allows investors to trade shares without triggering capital gains taxes typically.

How Liquid Are Etfs?

ETFs are generally highly liquid, as they can be bought and sold during trading hours at current market prices through the exchange.

Do Etfs Pay Dividends?

Many ETFs distribute dividends from the underlying assets they own, which investors can receive as cash or reinvest.

How Do You Choose An Etf?

Choosing an ETF involves considering factors like the index it tracks, expense ratio, liquidity, and performance history.

What Are The Risks Of Investing In Etfs?

Risks include market risk, liquidity risk, and tracking error, but these can vary greatly depending on the ETF’s specific assets and strategy.

Conclusion

Navigating the world of investments can be daunting. Exchange Traded Funds offer a path bridging simplicity and diversity. As we’ve explored, their affordability and accessibility make ETFs a compelling choice for both novice and seasoned investors. Embracing ETFs could mark the start of a strategic, well-diversified portfolio.

Start your investment journey wisely—consider the potential of ETFs.